Sugarbush Management

Going solar: Powering the sugarhouse with the sun

More maple syrup producers turning to sun to power their operations

By DEBORAH JEANNE SERGEANT | JULY 2017

According to the Governor’s office, solar use in New York grew 300 percent from 2011 to 2014. Gov. Andrew Cuomo’s Reforming the Energy Vision program plans to spend $1 billion on solar, which can help ag operators better afford to install solar panels.

Additional solar growth in New York State could come from another element in the REV program, a proposed $5 billion Clean Energy Fund, which would put investments into play over the next ten years across four portfolios: Market Development, Innovation and Research, NY Green Bank and NY-Sun.

Though this statistic includes numerous agricultural operations, many of those are dairies. Few of them are maple sugar producers.

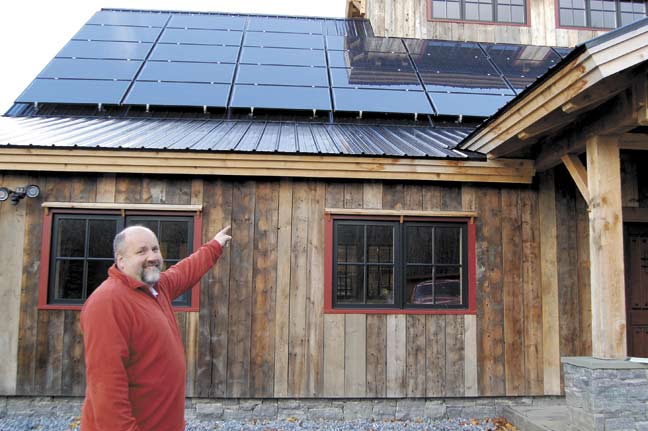

Karl Wiles, owner of Cedarvale Maple Syrup Co. in Syracuse, NY represents a solar pioneer in the state’s maple industry. He’s used solar for two years to power his sugar house, home, retail store and employee apartment above the store. He said that the system generates all the power his operation and home need for nothing. He pays a small fee to stay on the national grid. But only $22.70 monthly for all his home and business power needs is pittance compared with the former bills of $250 for his home, $208 monthly for the apartment and store and $2,000 annually for the sugar house.

Of course, Wiles had to pony up some of the $123,000 up-front cost for the panels and their installation. New York State Energy Research and Development Authority (NYSERDA) paid one-third of that cost.

“If you’re doing solar for a farm, there’s no limit what NYSERDA will subsidize,” Wiles said.

A federal tax credit kicked in to reimburse 20% of Wiles’ expense and a New York State tax credit provided $5,000 more. In his tax filing, Wiles writes off the depreciation on the business use of his solar equipment. State law says that a property’s tax assessment cannot increase because of the installation of solar panels.

Wiles purchased insurance on the panels in case they become damaged. It costs $600 annually.

Wiles funded the project from savings, since he felt the investment would provide a better return than stocks and bonds. The solar equipment is guaranteed to last 20 years. He estimates that within eight to nine years, it should pay for itself.

“If you’re 40 years old, and you want to expand, it might be hard to come up with the money,” Wiles said. “I did this in my 50s and I wasn’t trying to expand the business.”

At first, he had a little trouble with his town zoning board, since he had installed some of the panels on his house. Moving them to a farm lot solved the problem since Cedarvale is working farm.

Wiles hosts tours on his 2,700-tap operation. Instead of the sleek, modern panels detracting from what many view as a folksy, old-fashioned endeavor, “a lot of people actually give us a ‘Way to go,’” Wiles said. “They like the fact that we use solar.”

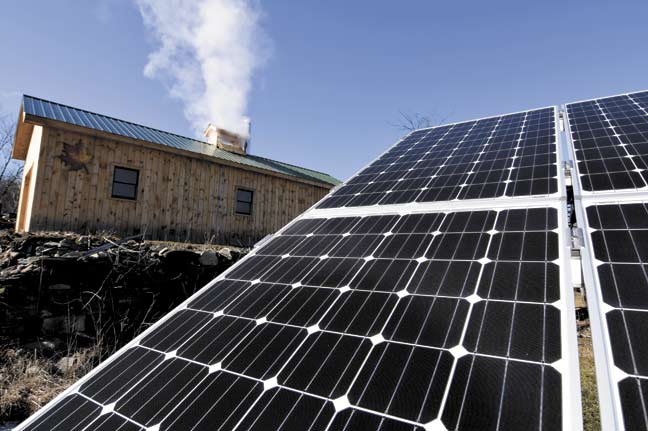

Though solar powers the reverse osmosis equipment, the farm still uses wood for the final evaporation.

“With fuel costs, the solar really helps us stay competitive with larger operations,” Wiles said.

Using solar power doesn’t mean that Wiles has power when the electricity goes out, since that trips breakers on the panels to protect workers repairing the lines.

Central New York receives plenty of snowfall, but Wiles purchased tower-based panels instead of roof-based panels, which make the snow slide right off once the sun warms them.

Installing solar panels on a farm thickly populated by trees seems illogical; however, by placing his panels south of the trees ensures they stay out of the shadows.

Using solar panels has helped Wiles build up solar credits that he can sell back to the power company. In addition to that revenue stream, Wiles anticipates a state program where he can sell “green credits” to other businesses.

“A big industry that’s a polluter may someday purchase the credits from you,” Wiles said. “That can be significant at some point.”

Despite his enthusiasm for solar, he realizes that “it’s not for everyone, because many homes aren’t right next to the sugar house for combining their power needs,” he said.

NYSERDA offers free energy audits to farms and on-farm producers, including maple producers. From a basic walk-through to a more in-depth audit, applicants choose the level of audit they need.

“After the audit is completed, we will be following up with the farm to go over potential funding options including utility and federal programs,” said Lisa Coven, contractor on behalf of NYSERDA and program manager for EnSave, Inc. in Richmond, VT.

Receiving professional assistance in choosing the right solar package and programs can make the process easier for producers and ensure they’re on track to a successful venture in solar energy.

“This is a great opportunity for maple producers considering an upgrade to solar,” Coven said. “A level III audit will set a maple producer up for success when considering the options of going solar. A free energy audit is a great starting point for understanding current energy use and mapping a plan for more sustainable operation.”

Originally published in The Maple Syrup Almanac in July 2016